Industry professionals at electronics products show discussing new products

Attending electronics industry events is a great opportunity to display your products and see first-hand impactful industry trends in components and technology. However, for IC manufacturers and other product makers, it is essential to view the industry from a market perspective. The 2025 Electronic Design Market Data Report is the resource that provides IC and electronics manufacturers with a deeper understanding of the trends, challenges, and drivers shaping the electronics industry in 2025. This report is designed to equip manufacturers with the knowledge to connect more effectively with engineers and meet their evolving needs. The report explores the reasons behind the industry’s current performance, focusing on component demand, sustainability trends, supply chain insights, and the impact of legislation like the U.S. CHIPS Act.

General Component Trends in The Electronic Design Market Data Report 2025

Notable in this electronic design market data report for 2025, component manufacturing is evolving with advanced materials and innovative processes, driven by the need for efficiency and adaptability. Materials like gallium nitride (GaN), nanocarbons, and graphene are being adopted as alternatives to traditional silicon, offering higher energy efficiency and performance in smaller form factors. Flexible components, especially in wearable technology and solar applications, are also rising, reflecting a demand for versatile, resilient designs.

The influence of IoT remains significant, as interconnected devices drive the need for supporting components that can seamlessly integrate across networks. Additive manufacturing techniques, such as 3D printing, are increasingly used to create custom parts for prototyping and small-batch production, offering cost-effective solutions for early-stage designs. Additionally, AI is playing a transformative role in component manufacturing, enabling data-driven workflow optimizations that enhance productivity and reduce production costs.

Component Sourcing and Management: Essential Strategies for Engineers

The recent supply chain disruptions, fueled by global events and spikes in electronics demand, have emphasized the importance of securing multiple sourcing options. The top distributors in the industry, including Digi-Key, Arrow, and Mouser, enable engineers to mitigate the risks of supply shortages by offering robust catalogs, diverse sourcing, and real-time availability insights, giving them flexibility and adaptability in their designs.

Effective Component Management Practices for Streamlined Design Processes

Efficient component management is an increasingly important key trend shaping PCB design, as engineers increasingly rely on centralized CAD libraries to streamline sourcing and reduce errors. These libraries provide verified, standardized models, which improve design consistency and collaboration. Additionally, parametric search functions help engineers filter components by specifications like tolerance or power rating, speeding up the selection process. For IC manufacturers, offering customized CAD models and library support aligns with engineers’ needs, simplifying sourcing and enhancing the quality and compatibility of complex PCB projects.

The CHIPS Act: Strengthening Domestic Semiconductor and PCB Manufacturing

The U.S. CHIPS and Science Act, with its $53 billion in funding, has initiated a significant transformation in the U.S. semiconductor industry. Designed to reduce reliance on offshore production, the act focuses on building domestic semiconductor fabrication capacity, fostering innovation through R&D, and strengthening the supply chain for critical industries. This shift will yield long-term benefits for PCB designers, component manufacturers, and end-users by creating a more resilient, streamlined supply chain and reducing lead times for essential components.

Immediate Impacts on Semiconductor Manufacturing and PCB Design

The CHIPS Act has driven significant investment in U.S. semiconductor facilities, with companies like Intel and Samsung expanding domestic production. This boost in capacity reduces reliance on foreign sources, mitigating supply chain disruptions. For PCB designers, shorter supply chains and quicker access to advanced components are expected to improve lead times and foster collaboration with manufacturers, paving the way for more innovative, high-performance PCB designs.

Research and Development: Fueling Innovation for Next-Generation Electronics

A significant portion of CHIPS Act funding is allocated to research and development, supporting advanced semiconductor technologies, such as AI-driven chips, quantum computing components, and specialized sensors. These investments are expected to enhance the capabilities of U.S. manufacturers and drive innovation in areas critical to the future of electronics, including IoT, automotive electronics, and consumer devices. With access to the latest R&D advances, PCB designers can integrate more sophisticated features and capabilities into their designs.

Looking Ahead: The CHIPS Act’s Projected Impact Through 2025

As we move into 2025, the CHIPS Act is poised to continue reshaping the semiconductor landscape. The year will likely see the completion of several new fabrication plants, further strengthening domestic production capacity. This expansion is expected to yield benefits for PCB designers, such as quicker prototyping cycles and improved integration of cutting-edge components into design processes.

Additionally, the collaborative ecosystems being formed around these new facilities are likely to encourage more direct partnerships between IC manufacturers and PCB design teams. This could lead to developing more optimized, high-performance PCBs tailored to the specific demands of sectors such as automotive, defense, and consumer electronics.

The anticipated economic impact of these developments is also significant. With a reinforced semiconductor supply chain and expanded domestic capacity, the U.S. is expected to become more competitive globally, reducing costs and enhancing technology leadership in the industry. For engineers, designers, and manufacturers, the CHIPS Act provides a solid foundation for sustained innovation and resilience, setting a positive trajectory as we look further into 2025 and beyond.

Electronic Component Projected Trends for 2025

Lead times for electronic components have improved through 2025, following years of severe supply chain disruptions caused by the COVID-19 pandemic, increased global demand for electronics, and raw material shortages. These lead times have affected various components differently; for example, DDR3 and DDR4 memory modules saw lead times decrease by up to 59% for some models. Flash NAND components, crucial in many high-speed data applications, experienced a similar decline, with lead times dropping from up to 26 weeks to around 10–15 weeks in early 2024.

Market Growth and Component Demand Projections for 2025

The electronic component market is expected to continue its upward trend through 2025, driven by robust demand in sectors like consumer electronics, automotive, and telecommunications. World Semiconductor Trade Statistics (WSTS) forecasts a 12.5% growth in the global semiconductor market in 2025, reaching a total value of $687 billion. This growth will be fueled by significant gains in specific component categories:

- Memory ICs: Expected to grow by 25.2%, reaching over $204 billion by 2025.

- Logic ICs: Forecasted to expand by 10.4%, contributing to a total sector value of $218 billion.

- Discrete Semiconductors: Projected to increase by 7.7%, supporting a wide range of applications, particularly in automotive and power electronics.

Other components, like analog ICs and sensors, are expected to see moderate growth in the 6-7% range, with analog ICs reaching approximately $84 billion. This steady demand reflects the ongoing digital transformation across industries, as well as the growth of the IoT, 5G networks, and AI applications, which require increasingly complex and capable components.

Projections for Lead Times in 2025

Looking into 2025, the electronics industry may face continued variability in lead times depending on component type and market segment. Although increased domestic manufacturing capacity, supported by initiatives like the CHIPS Act, is expected to improve the overall supply chain, the possibility of sporadic shortages remains. Components such as advanced analog ICs, sensors, and memory modules, which are essential for high-performance and data-intensive applications, may experience fluctuating lead times due to sustained demand and the complex nature of their production.

Manufacturers and distributors must continue developing flexible sourcing and inventory strategies to meet demand without costly delays. The improvements seen in 2024 are encouraging, but they underscore the necessity of adaptable supply chains and diversified sourcing strategies as the industry looks ahead to another year of growth and innovation in 2025.

PCB Design Trends for Popular Components

As of the time of this article, although 2024 isn’t over just yet, we can use key statistics from Ultra Librarian’s year in 2023 to make further projections into 2025. In 2023, specific component types stood out in PCB designs, reflecting key design priorities across the industry. Notable high-demand components included the M24C02-WBN6P (an I2C EEPROM) from STMicroelectronics, LTC4310CDD-2#PBF (an I2C isolator) from Analog Devices, TRF7960RHBT (RFID reader/writer) from Texas Instruments, and the STM32F103C8T6 (a 32-bit Arm-based microcontroller) also from STMicroelectronics. Notably, aside from the STM32F103C8T6, which is a microcontroller with moderate complexity, the most popular components had simpler designs in terms of symbol and footprint. This preference for efficient, high-performance components suggests a trend toward streamlined designs that prioritize reliability and trusted sources.

Popular Reference Designs

Reference designs have become essential for engineers developing wearable, IoT, and AI-driven applications. In 2023, over 8,500 reference designs were downloaded, with Analog Devices’ MAXREFDES104 and MAXREFDES103 health sensor platforms and TDK’s DC-DC multi-module set as top choices. The BeagleBone AI-64 development platform also saw significant interest, highlighting the demand for AI-capable tools. Health and fitness reference designs were particularly popular, reflecting the growing role of wearable tech and portable health monitoring devices in consumer electronics. This trend points to an expanding market focus on health-oriented wearables and AI-enabled devices, which rely heavily on reference designs to reduce development time and enhance integration with sensors and AI processing units, particularly as health-focused electronics continue to grow in both consumer and medical sectors

Online Parts

In 2023, engineers increasingly relied on online parts repositories for essential components, leveraging digital resources for streamlined component selection. The most requested component builds included Honeywell’s SD5421-002, Texas Instruments’ F28386SPTPQR, and Alpha and Omega Semiconductor’s AOTL66912, among others. Additionally, high-download components like FTDI’s FT232RL-REEL and Texas Instruments’ LMR51450FNDRRR indicate a trend toward standardization and trusted part sources. The preference for online parts builders highlights a shift from custom component design to standardized online resources that offer reliable CAD models and verified specifications. This move allows engineers to expedite design processes, reduce the risk of sourcing errors, and easily replace outdated parts, marking a clear industry shift toward digital component sourcing to optimize time and accuracy in PCB development.

Sustainable and Alternative Electronics Balancing Cost and Environmental Impact

In this electronic design market data report, it’s also important discussing the trend toward sustainable electronic components. With consumers, regulatory bodies, and corporations demanding greater eco-friendliness, there has been an increased focus on offering components that meet these requirements, despite the higher associated costs.

Several sustainable components have been designed with both performance and environmental impact in mind. For instance:

- Recycled Metal Film Resistors: These resistors use recycled materials, reducing emissions and the need for raw resource extraction.

- Organic Polymer Capacitors: These capacitors have a high cost due to material composition but are biodegradable and carry lower toxicity, making them more eco-friendly.

- Gallium Nitride (GaN) Transistors: GaN transistors, while costly, offer high energy efficiency and reduced power consumption, aligning well with sustainability goals.

- Solid-State Batteries: Incorporating recyclable materials, these batteries eliminate the need for liquid electrolytes, reducing e-waste and offering longer life cycles compared to traditional batteries.

In each case, while sustainable components often involve a higher initial cost, they present long-term benefits through energy savings, reduced waste, and extended product life spans, leading to lower operational expenses.

Sourcing Sustainable Components for Environmental and Market Alignment

To effectively support engineers in designing sustainable products, engineers are working with manufacturers for sourcing and inventory strategies.

- Sustainable sourcing begins with partnering with suppliers who prioritize eco-friendly materials, energy efficiency, and green manufacturing processes. For example, manufacturers can ensure components align with sustainability standards like REACH and RoHS to filter suppliers based on their environmental impact.

- Inventory management systems can be further adapted to include “green categories,” making it easier for engineers to identify eco-friendly options. To improve customer awareness, some manufacturers provide a “sustainability index” or rating for each component, enabling engineers to make informed choices based on environmental impact. These measures allow distributors to not only cater to sustainability-conscious engineers but also to lead the industry in responsible practices.

Connecting with Engineers as an IC Manufacturer

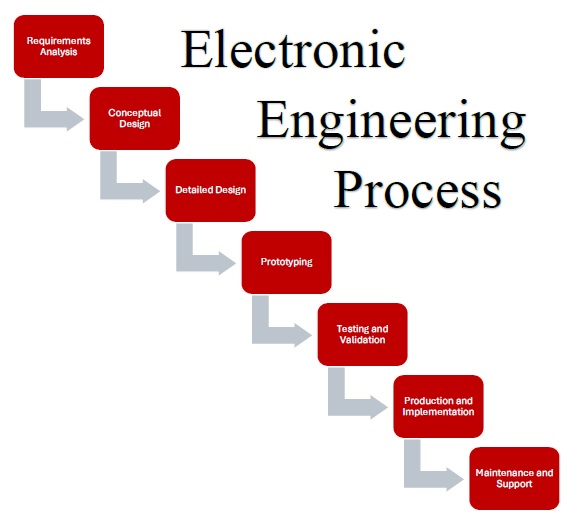

The role of the engineer has evolved alongside the growing complexity of PCB assembly (PCBA) design, manufacturing, and testing processes. As IC manufacturers seek to connect with engineers—especially those entering the field—it’s essential to understand the dynamics of the engineering mindset and establish resonate outreach strategies.

Traditionally, engineers have relied on institutions, professional organizations, and on-the-job training. However, today’s engineers increasingly turn to digital platforms and online resources for guidance. Below are some effective approaches to connecting with this critical audience.

GUIDELINES FOR CONNECTING WITH ENGINEERS | ||

Strategy | Key Points | Goal |

Understanding the Engineering Mindset | – Engineers prefer modular, data-driven communication. | Establish credibility and engagement by aligning with engineers’ logical approach. |

Highlighting the Engineering Impact | – Emphasize product contributions to broader goals (efficiency, technology, sustainability). | Show respect for engineers’ role and align with their values. |

Speaking the Language of Engineering | – Use precise, up-to-date terminology. | Build trust through technical fluency and relevance. |

Leveraging Digital and Social Media | – Engage on platforms like LinkedIn and Twitter. | Increase visibility and connect with engineers where they seek insights and resources. |

Providing Relevant, Accessible Info | – Share concise, useful content. | Build trust by being a reliable, time-efficient resource. |

Unlock faster innovation and optimal outcomes with Accelerated Designs. With access to the latest EDA software, diverse data, and the industry’s most comprehensive PCB CAD-content digital library, we provide the tools, technologies, and expertise to reduce development costs, speed time to market, and overcome common design challenges. Contact Accelerated Designs to start optimizing your design process today.